Posted on 10/08/2018 17:49:05 by Shahzad Mahmood

Equity and Debt - How are they different?

Up until recently, investments on CrowdLords have all been equity investments where Investors own shares in the company carrying out the development or buying the rental units. In return they receive a share of the profits.

Our understanding is that these investments have appealed to investors with some understanding of property developments and who feel comfortable with the fact that their returns may be higher or lower than projected.

We recently launched our first Debt investment, which we believe might appeal to investors looking for more certainty in their returns and to enable others to balance the risk in their portfolio. However, investors should still note that as with all investments of this nature, returns are not guaranteed.

How is Debt different?

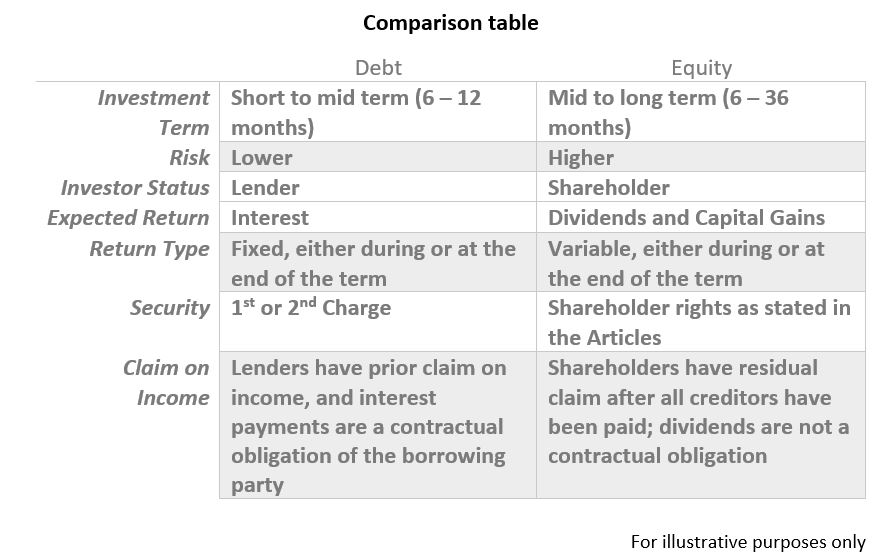

All our Debt investments are secured via either a 1st Charge or 2nd Charge on the property and therefore have a lower risk profile compared to equity investments, as assessed by CrowdLords. This should result in a lower, but more consistent return.

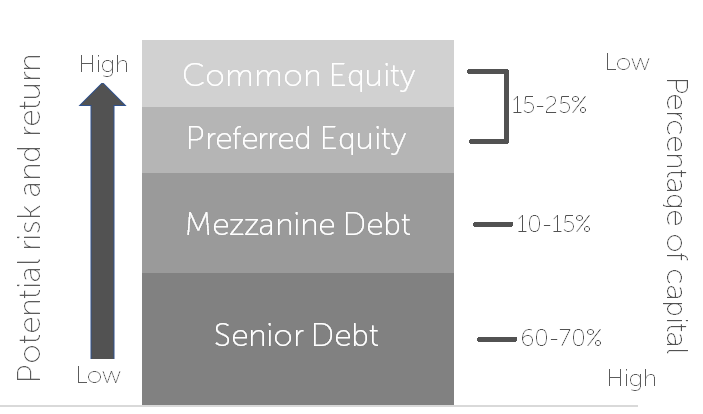

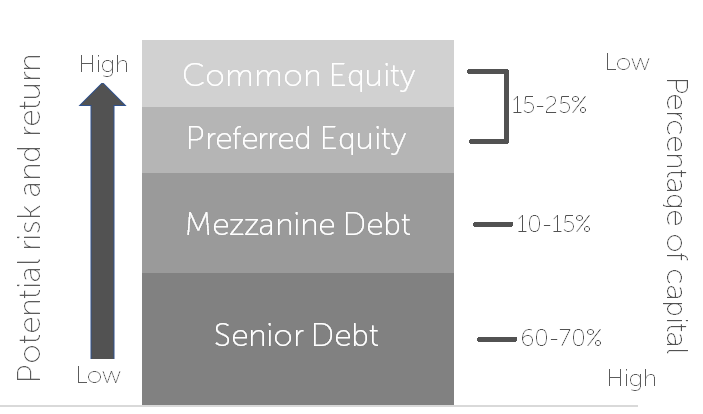

Equity investments in general [AB1] are considered to be high risk investments that can earn a significant rate of return typically between 15 – 25% p.a. along with the potential to earn more than the projected returns. However, Investors can only usually be repaid their capital along with any gains once the lenders have been repaid. Where possible we look to include ‘preferred minimum returns’, which is the return investors receive before the developers are able to take any of their share of the profits, and any further profits will be distributed based on the agreed investment structure.

Debt investments on the other hand are often considered as lower risk than equity investments and as you would expect, they generally yield a lower return. The debt instrument we use is a Bond, a legally binding contract between an investor and borrower (such as an SPV), stating the bond principal and maturity date. Debt investors enjoy the benefit of knowing their returns when they enter into the investment.

It is worth noting that like equity investments, debt investment returns are also not guaranteed They should also be clear on who gets paid when. If they enjoy a 1st Charge, as the name suggests they get paid first before anybody else. If it is 2nd Charge, as with Mezzanine Debt for example, then they get repaid only after the 1st Charge lender has been repaid both their principal and any interest due.Why offer both?

Most experts would recommend a balance of potential risk and reward within any portfolio and that balance should depend on your financial situation and your attitude to risk. Financial advisors often suggest that your risk profile should be adjusted as you get older, prepare for retirement and when you retire.

Our stated goal is to make property investment easier, more accessible and more productive for more people. We can only do that if we have a range of products that can be combined to satisfy different risk appetites.

Ultimately, we aim to provide the entire capital stack, enabling investors the opportunity to potentially grow their portfolio and adjust the risk and reward to match their needs more precisely.

Our understanding is that these investments have appealed to investors with some understanding of property developments and who feel comfortable with the fact that their returns may be higher or lower than projected.

We recently launched our first Debt investment, which we believe might appeal to investors looking for more certainty in their returns and to enable others to balance the risk in their portfolio. However, investors should still note that as with all investments of this nature, returns are not guaranteed.

How is Debt different?

All our Debt investments are secured via either a 1st Charge or 2nd Charge on the property and therefore have a lower risk profile compared to equity investments, as assessed by CrowdLords. This should result in a lower, but more consistent return.

Equity investments in general [AB1] are considered to be high risk investments that can earn a significant rate of return typically between 15 – 25% p.a. along with the potential to earn more than the projected returns. However, Investors can only usually be repaid their capital along with any gains once the lenders have been repaid. Where possible we look to include ‘preferred minimum returns’, which is the return investors receive before the developers are able to take any of their share of the profits, and any further profits will be distributed based on the agreed investment structure.

Debt investments on the other hand are often considered as lower risk than equity investments and as you would expect, they generally yield a lower return. The debt instrument we use is a Bond, a legally binding contract between an investor and borrower (such as an SPV), stating the bond principal and maturity date. Debt investors enjoy the benefit of knowing their returns when they enter into the investment.

It is worth noting that like equity investments, debt investment returns are also not guaranteed They should also be clear on who gets paid when. If they enjoy a 1st Charge, as the name suggests they get paid first before anybody else. If it is 2nd Charge, as with Mezzanine Debt for example, then they get repaid only after the 1st Charge lender has been repaid both their principal and any interest due.Why offer both?

Most experts would recommend a balance of potential risk and reward within any portfolio and that balance should depend on your financial situation and your attitude to risk. Financial advisors often suggest that your risk profile should be adjusted as you get older, prepare for retirement and when you retire.

Our stated goal is to make property investment easier, more accessible and more productive for more people. We can only do that if we have a range of products that can be combined to satisfy different risk appetites.

Ultimately, we aim to provide the entire capital stack, enabling investors the opportunity to potentially grow their portfolio and adjust the risk and reward to match their needs more precisely.

Related Articles

- Is post-war property a good investment?

- Can post-coronavirus unused office space resolve a nation's housing crisis?

- Are you an optimist or a pessimist in Property Crowdfunding?

- Need a hand with puzzling alternative finance jargon?

- Seven myths and one truth about Property Crowdfunding

- Understanding Loan to Value (LTV) - Part II

- Understanding Loan to Value (LTV) - Part I

- Construction workers given the green light to work despite the Coronavirus pandemic

- Is Coronavirus likely to slow down growth in the UK's property market?

- How the decline of UK's High Streets is opening the way for UK property developers

- Who should you turn to for investment advice before Property Crowdfunding?

- Is property crowdfunding a viable way to get onto the property ladder these days?

- The importance of liquidity in your investment portfolio

- FCA guidance changes ring in the new year

- Gender stereotypes in Alternative Finance; are women playing catch-up?

- How does CrowdLords compare?

- Brighton Road - Meet the Developer

- Property Crowdfunding; A Global Appeal for UK Platforms?

- Does the future of Property Crowdfunding lie in the hands of Millennials?

- Meet the Developer - Jo Hagan (5 Mentmore Terrace)